In today’s fast-paced world, managing finances effectively is crucial for securing a stable financial future. Fortunately, with the advancements in technology, there are numerous free budgeting apps available to assist in tracking expenses, setting financial goals, and ultimately saving money. Here, we’ll explore three top-notch good budgeting apps that not only help you keep a close eye on your spending but also come with the added benefit of being free to use.

Mint (Android, iOS)

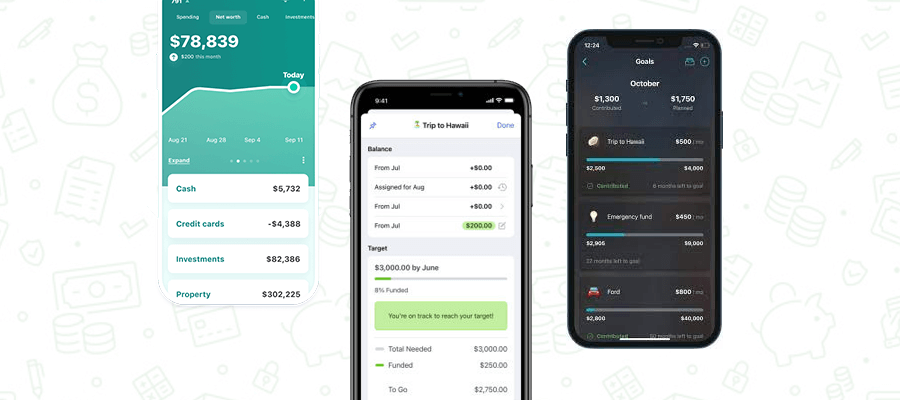

Mint stands out as one of the most popular and comprehensive budgeting apps on the market. Developed by Intuit, the same company behind TurboTax and QuickBooks, Mint offers users a holistic approach to managing their finances. The app syncs with users’ bank accounts, credit cards, and other financial accounts to provide a real-time overview of their financial health.

Key features include the ability to create budgets, track expenses, receive bill reminders, and even get personalized money-saving tips. Mint’s user-friendly interface and customizable categories make it suitable for users of all financial backgrounds.

YNAB (You Need A Budget) (Android, iOS)

YNAB takes a proactive approach to budgeting by focusing on giving every dollar a job. The app emphasizes the importance of assigning each dollar to a specific purpose, whether it’s for bills, savings, or discretionary spending. YNAB’s philosophy revolves around four key rules: give every dollar a job, embrace your true expenses, roll with the punches, and age your money.

YNAB offers features such as goal tracking, debt payoff planning, and detailed reports to help users gain better control over their finances. While YNAB does come with a subscription fee after the free trial, its effectiveness in helping users save money justifies the cost for many.

PocketGuard (Android, iOS)

PocketGuard simplifies the budgeting process by providing users with a clear snapshot of their financial situation at a glance. The app links to users’ bank accounts, credit cards, loans, and investments to analyze spending patterns and identify opportunities for saving money. PocketGuard’s main strength lies in its simplicity and ease of use.

With features like budget tracking, bill tracking, and savings goals, PocketGuard helps users stay on top of their finances without overwhelming them with complex tools or jargon. The app also offers personalized insights and recommendations to help users make smarter financial decisions.

In a world where saving money is increasingly important, leveraging technology to manage finances efficiently has become essential. The top three money saving apps mentioned above – Mint, YNAB, and PocketGuard – offer powerful tools and features to help users track expenses, set financial goals, and ultimately save money. Whether you’re an Android or iOS user, these free budgeting apps provide valuable resources to help you take control of your finances and work towards a more secure financial future.

I appreciate how user-friendly YNAB is – even for someone like me who isn’t naturally inclined towards budgeting.

I’ve been using PocketGuard for a few months now, and it’s completely transformed the way I manage my finances. Highly recommended!

After trying several budgeting apps, I’ve found that Pocket Guard strikes the perfect balance between functionality and simplicity. It’s become an essential tool in managing my finances.

3 comments on “3 Free Budgeting Apps to Help You Save Money”